Compound interest is often regarded as a wonder, a tool that magnifies wealth through its intrinsic ability to generate earnings on earnings. This financial principle extends beyond the realm of mere interest accrual, offering a gateway to exponential growth for diligent investors. In this exploration, we delve into the nuances of compound interest, its profound impact on investment strategies, and how fintech tools can optimize its potential.

What is Compound Interest?

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. In simpler terms, it’s interest that earns interest. This compounding effect allows your investments to grow exponentially over time.

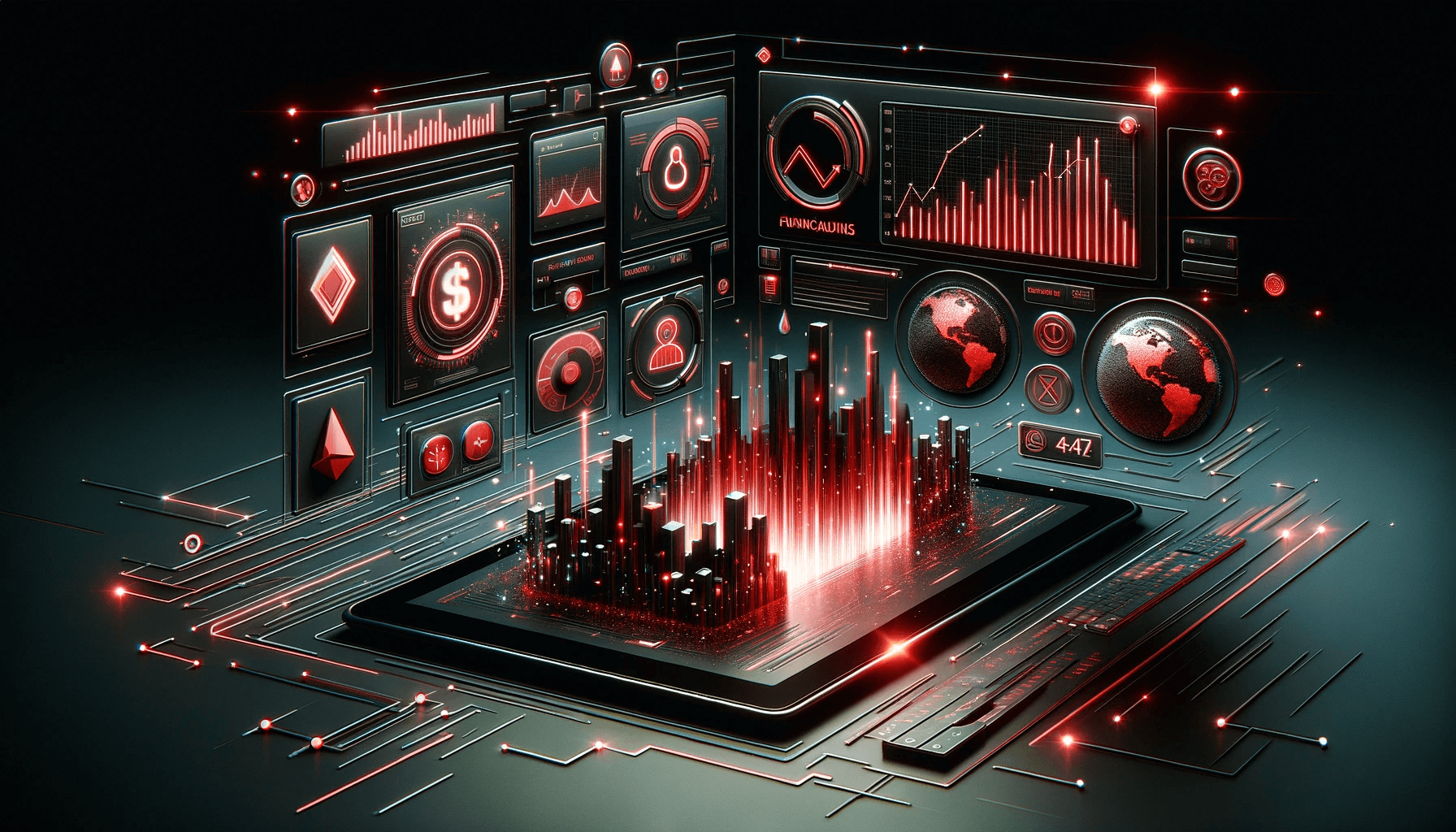

The formula for compound interest is:

Where:

- A is the future value of the investment/loan, including interest.

- P is the principal amount (the initial investment or loan amount).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested or borrowed for.

To Better Illustrate…

Consider investing $10,000 with an annual interest rate of 5%, compounded annually. After one year, your investment would be worth $10,500. Now, here’s where it becomes intriguing: in the second year, you not only earn 5% on your initial $10,000 but also on the $500 interest from the first year.

Following the second year, your total would reach $11,025, not merely $10,750. This compounding effect persists, continually multiplying your money, making it a fundamental strategy for long-term wealth accumulation. This showcases the remarkable financial potential of compound interest.

Deciphering Compound Interest

The essence of compound interest is the accumulation of interest on the initial principal, which includes all of the accumulated interest from previous periods.

This concept differs fundamentally from simple interest, where returns are calculated solely on the principal amount. The quintessence of compound interest lies in its ability to escalate the value of an investment exponentially over time, marking a pivotal strategy in wealth accumulation.

Advantages of Compound Interest in Investment

Now, let’s explore the advantages of compound interest:

Accelerated Wealth Accumulation

Compound interest’s most salient advantage is its capacity to hasten wealth accumulation. It turns the concept of earning interest on your interest into a powerful mechanism for wealth growth.

Consider two scenarios:

Scenario 1: You invest $10,000 at an annual interest rate of 5%, compounded annually. After 10 years, your investment grows to approximately $16,386.

Scenario 2: You invest the same $10,000, but with simple interest (5% annually). After 10 years, your investment would only be worth $15,000.

The power of compound interest in Scenario 1 is evident. It allows your money to work harder and generate more significant returns.

Tailored for Long-Term Objectives

The true might of compound interest is best wielded over extended periods. This quality makes it particularly suited for long-term financial objectives like retirement planning or educational savings.

Promoting Consistent Savings

The promise of substantial returns from compound interest serves as a motivator for regular and disciplined saving habits, a cornerstone of sound financial planning.

Counteracting Inflation

Inflation gradually erodes the purchasing power of money. Compound interest combats this erosion by potentially growing investments at a rate that outpaces average inflation, preserving or even enhancing the real value of savings.

Passive Income Generation

Compound interest can lead to the creation of passive income streams. As your investments grow, the interest generated can provide a steady income without requiring active work. This can be a game-changer for those looking to achieve financial independence.

Fintech: Harnessing Compound Interest

The fintech revolution has introduced tools and platforms that enhance the ability to leverage compound interest in investments:

| Robo-Advisors |

| Betterment and Wealthfront epitomize the fusion of technology and investment strategy, optimizing portfolios for the compounding effect. |

| Compound Interest Calculators |

| Tools such as Investor.gov’s Compound Interest Calculator allow investors to visualize potential investment growth. |

| High-Interest Savings Accounts |

| Digital banks like Ally Bank and Marcus by Goldman Sachs offer savings accounts with attractive interest rates conducive to compounding. |

| Retirement Accounts |

| Platforms such as Vanguard and Fidelity provide IRA and 401(k) accounts, where compound interest plays a crucial role in wealth accumulation. |

| Investment Apps |

| Apps like Robinhood and Acorns allow you to invest in stocks and exchange-traded funds (ETFs) with ease. They often offer automated features that reinvest your dividends, maximizing the power of compound interest. |

To start taking advantage of compound interest, consider the following steps:

Start Early

The principle of ‘the earlier, the better’ is profoundly true for compound interest. Initiating investments early provides a longer horizon for interest to compound, magnifying the final outcome.

Set Clear Financial Goals

Determine your financial objectives, whether it’s saving for retirement, buying a home, or creating an emergency fund. Having clear goals will guide your investment strategy.

Create a Budget

Establish a budget that allows you to consistently allocate funds for investments. Fintech apps like Mint and Personal Capital can help you track your expenses and identify areas where you can save.

Choose the Right Investment Vehicles

Select investments that align with your goals and risk tolerance. Diversify your portfolio to minimize risk. Fintech tools like robo-advisors can assist in creating a well-balanced portfolio.

Reinvest Earnings

Channeling dividends and interest back into the investment rather than withdrawing them can significantly enhance the compounding effect.

Gradual Contribution Increases

As income grows, incrementally increasing investment contributions can result in larger compound interest gains.

Conclusion

Compound interest stands as a testament to the power of patience and consistency in the investment world. Its ability to turn modest savings into significant wealth over time is unparalleled.

Fintech tools have not only made it easier to capitalize on this financial phenomenon but have also made it accessible to a broader audience. With the right approach and tools, compound interest can be a formidable ally in achieving financial independence and long-term financial goals.

Frequently Asked Questions (FAQs)

- What differentiates compound interest from simple interest?

Compound interest generates earnings on both the initial principal and the accumulated interest, unlike simple interest which only earns on the principal.

- Is compound interest more beneficial for short-term or long-term investments?

Long-term investments benefit more significantly from compound interest due to the extended period over which interest can compound.

- Can regular contributions to an investment amplify the effects of compound interest?

Yes, regular contributions increase the principal amount, which in turn enhances the compound interest effect, leading to greater wealth accumulation over time.

- How does compound interest impact retirement savings?

Compound interest plays a critical role in retirement savings, as it allows the initial contributions to grow exponentially over the working life, resulting in a larger retirement fund.